Purchasing a Home in the Current Market

Purchasing a home in the current market

In September there was a lot of talk on the return of the real estate summer slowdown. I addressed the concern and panic among some sellers in my newsletter, and how this shift is an integral part of the ever-evolving real estate landscape. This volume will focus on the advantages of being a purchaser in the current market.

Healthy Market Stability: While the market's pace may have slowed down, it’s important to recognize that this is a sign of a healthy and balanced market. Buyers now have the opportunity to conduct thorough due diligence before finalizing a property purchase. Conditions like financing, inspections, and sale of property are back in play, allowing buyers to make informed decisions.

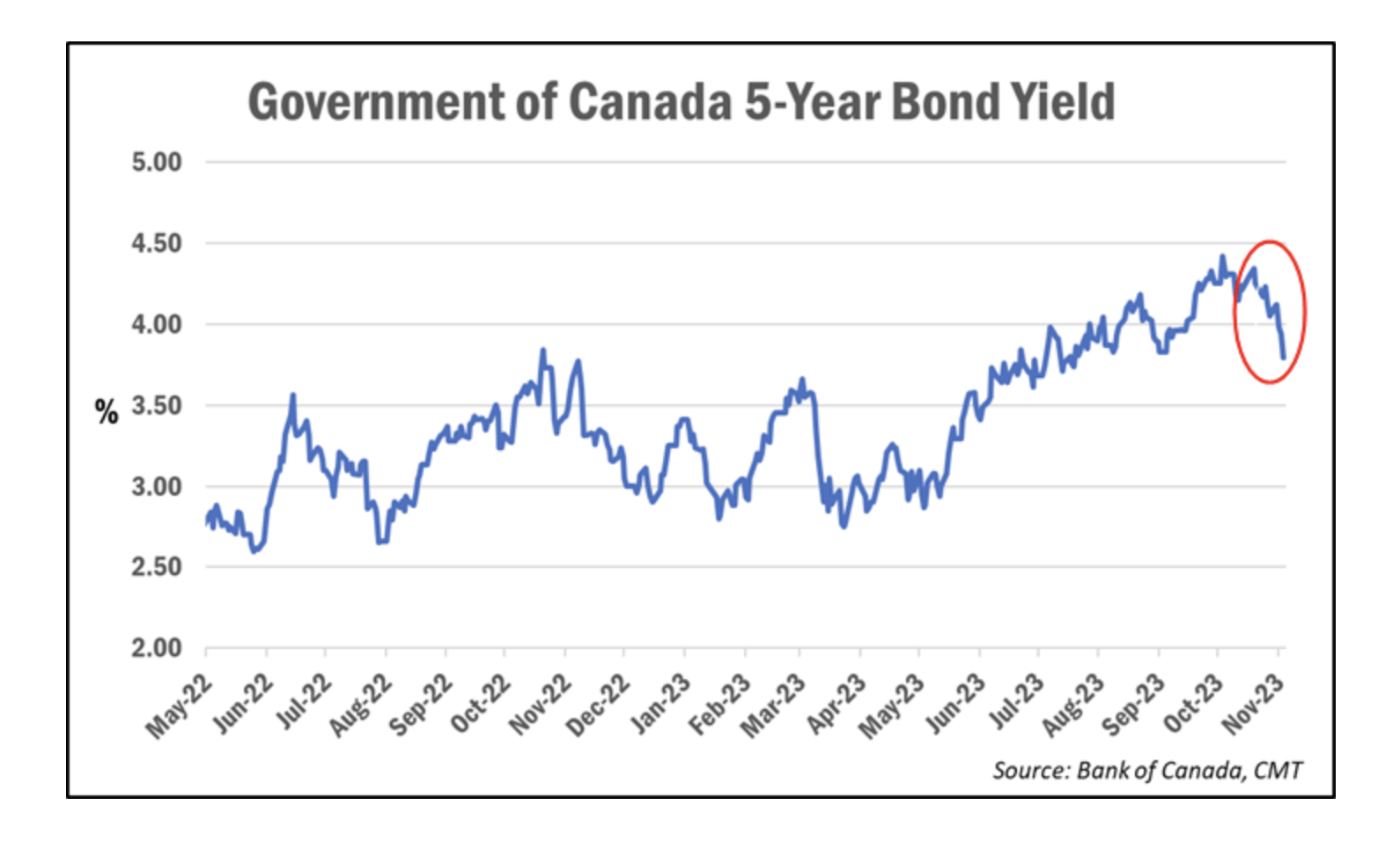

Fixed Interest Rates: The topic of interest rates has recently experienced day-to-day fluctuations. With the Bank of Canada bond yields decreasing this week, we anticipate a continued reduction in fixed mortgage rates. It's important to note that bond yields and fixed mortgage rates have a direct connection. Meaning when bond yields lower, fixed interest rates decrease. Although lenders have begun to reduce their fixed rates, the decrease is not as significant as the fall in bond yields. Current rates for an insurable 5-year fixed are 5.75%. Lenders rates tend to take the elevator on the way up and the stairs on the way down. Overall this is excellent news for anyone with a mortgage renewal approaching in the near future.

Your Current Mortgage: This is a crucial topic that may determine whether now is the right time to make a move. Some mortgages are portable (check with your mortgage agent to confirm if yours is). If this is the case, you will be able to transfer the remaining balance of your mortgage to another property, while the amount above and beyond is calculated at today's rate. This might be a great time for you to make a move. Why? The majority of purchasers are qualifying their entire mortgage at today's rate. This means that your transferable mortgage enhances the overall affordability. You might be wondering, "What happens when I have to renew my mortgage?" Well, we can't predict the future, but based on reports from the Bank of Canada and major Canadian banks, both fixed and variable mortgage rates are expected to continue to decrease in the foreseeable future.

Strategies for Sellers: After considering the information above, you may be thinking this is a good opportunity. It's important to remember that homes are not selling as quickly as they once were. Now, more than ever, it's crucial to price your property correctly and market it effectively.

Correct Pricing: Analyzing recent sales and market trends to determine a competitive and realistic asking price for your property is crucial in this market. Pricing your home in line with market conditions can help attract more buyers, reduce the time to sell, and make the selling process less stressful.

Staging and Presentation: Having an agent who invests in home staging and presentation is important. A well-staged home can make a significant difference in attracting potential buyers, even in a slower market.

Effective Marketing: Ensure your property is well-marketed, both online and offline. High-quality photos, detailed listings, and targeted marketing strategies can make your home stand out and attract more showings.

Flexibility: Be open to negotiations and flexible with terms. Consider offers that may involve a slightly longer closing period or other concessions to make your property more appealing.

In conclusion, the shifts in the market have opened up many excellent opportunities for individuals and families looking to make a move. With the right strategies and guidance, both buyers and sellers can confidently navigate these changes and successfully transact in the Guelph real estate market.

Here at the Hudson Smith Real Estate Group, we are committed to providing you with the best advice and support for all your real estate needs. We understand the local market intricacies and tailor our services to your unique needs.

If you have any questions about Guelph and the surrounding market, don't hesitate to reach out. We're here to assist you at every step of the journey.

Written by: Mathew Scott, Sales Representative

Share this post on