Rising Home Prices: What Will My Kids Do?

In contrast to other investment opportunities, real estate has always made the most sense to me for a number of reasons, but here’s just one example of why: if I buy an investment property and it increases in value by 10%, it increases in value by 10% on the total value of the property, not just the down payment, therefore amplifying my return.

“Sure, there is more work in owning a home, but that may be a small price to pay. After all, my kids can’t live in Apple stock.”

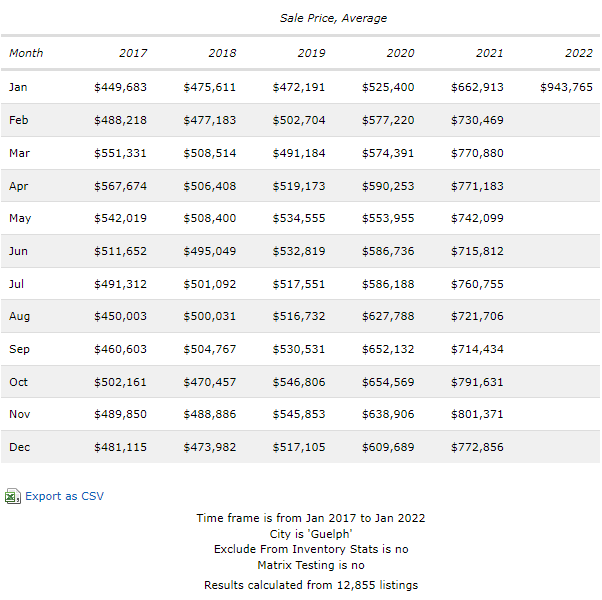

Look at how the returns have differed between conventional stock investment and real estate over the past years (see chart below). If a purchased Apple stock share increases in value by 10%, the increase is proportional to the original amount invested, while in comparison, the return on a real estate investment can be leveraged to provide additional investment opportunities.

The reality is, home prices in our lovely city have markedly increased, however, compared to other cities around us, they still offer incredible value. You could look at it and say, ‘maybe our kids will decide to live elsewhere, maybe they have a well-paying job and this conversation is moot anyway’, or just hope prices come down. These seem like low percentage bets.

“Hoping prices come down means that you are betting for something history has already proven wrong.”

Saving for our kids’ futures is nothing new. I feel that home prices have just made it clearer and investing in something we know they will need just seems to make more sense anyway. Time has always been a real estate investor’s best friend, we just need to decide when we start that clock.

Share this post on