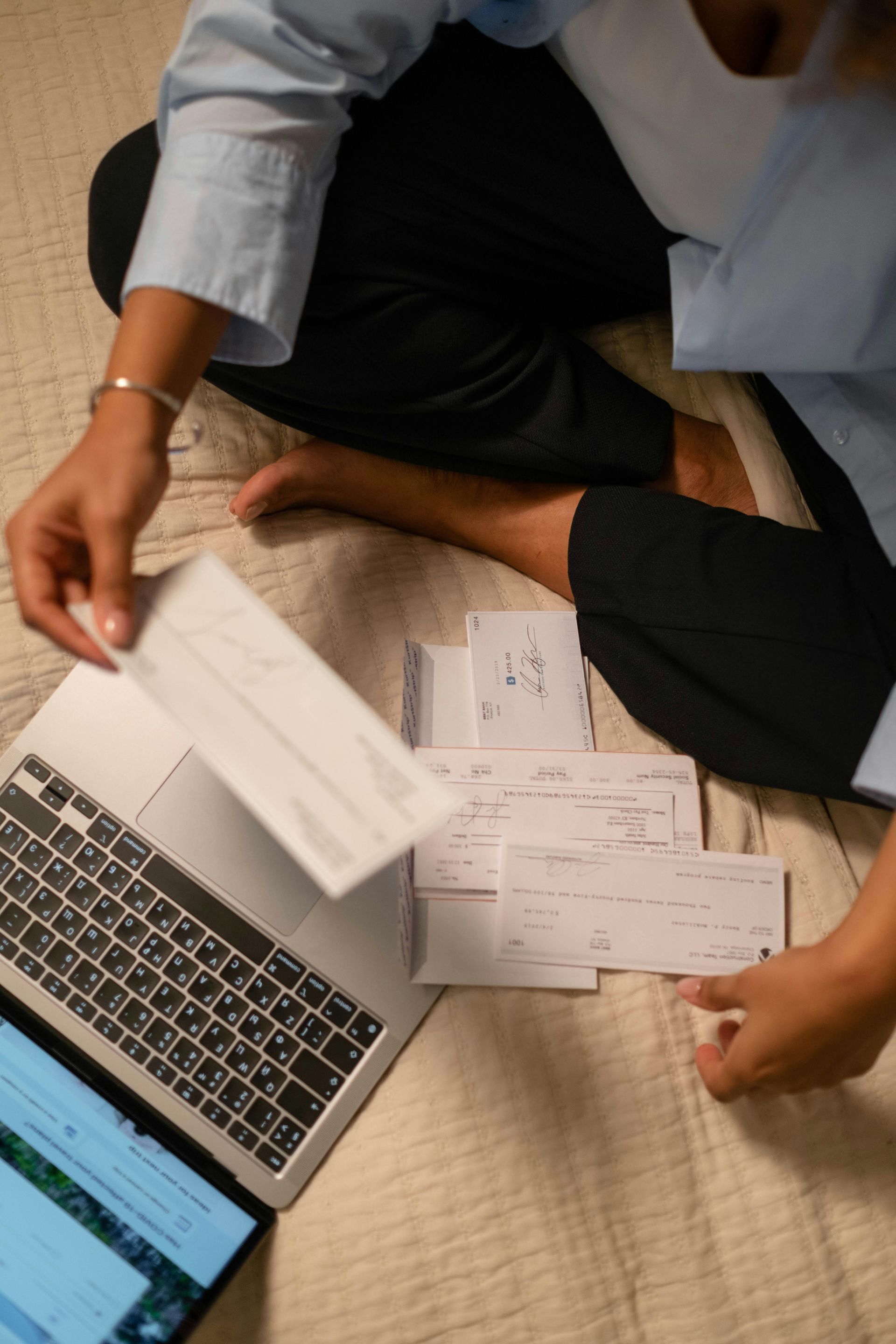

You've Opened Escrow, Now What?

The deposit check will be cashed. Assuming the sale goes through, this money will be applied to the purchase price of the home. If for any reason the sale is not consummated, you may be entitled to receive all of your deposit back, less standard cancellation fees. In certain instances, the seller may be able to retain this money as liquidated damages. Prior to executing a purchase contract, it would be wise to speak with your counsel regarding whether or not it is your best interest to have a liquidated damages clause as part of the contract.

The period that you are “in escrow” is often 30 days, but may be longer or shorter. During this time, each item specified in the contract must be completed satisfactorily. By the time you have opened escrow, you have come to an agreement with the seller on the closing date and the contingencies. Each contract is different, but most include the following:

Inspection contingency: this should be completed as soon as possible after the contract to purchase is signed as unsatisfactory results of the inspection may mean that you will want to cancel the contract.

Financing contingency: once the contract is signed, you have a period of time to secure funding. If, for any reason, you are unable to secure funding during the period of time granted to you by the contract (and the seller will not provide a written extension of time), you must decide whether you want to remove the contingency and take your chances on getting a loan. You may choose to cancel the purchase contract.

A requirement that the seller must provide marketable title.

With an attorney or title officer, review the title report. The title must be “clear” to ensure that you do not have legal issues regarding your ownership.

Check into local and state ordinances regarding property transfer and make sure that you and/or the seller have complied with them.

Secure homeowner’s insurance. This will probably be required before you can close the sale. Due to such requirements as special fire and earthquake insurance, obtaining this insurance may require a lengthy period of time. It would be in your best interest to apply for insurance as soon as possible after the contract is signed.

Contact local utility companies to schedule to have service turned on when you close escrow.

Schedule the final walk-through inspection. At this time, you should make sure that the property is exactly as the contract says it should be. What you thought to be a “permanently attached” chandelier that would come with the property might have been removed by the seller and replaced with a different fixture entirely.

You’ve made it! Once the sale has closed, you’re the proud owner of a new home. Congratulations!

Share this post on